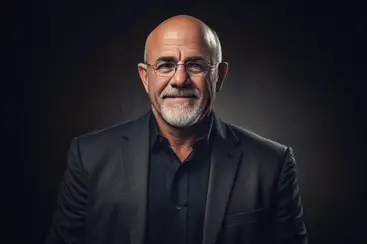

Financial expert Dave Ramsey often stresses that wealth isn’t necessarily about high income but rather effective money management. Contrary to the belief that earning more guarantees wealth, Ramsey argues that disciplined spending and consistent saving are what truly make the difference. Known for his straightforward financial advice, Ramsey has helped millions manage debt and achieve financial freedom. Here are four key habits he believes set the truly wealthy apart:

1. They Don’t Dress to Impress

Truly wealthy people follow a financial plan, prioritizing savings and avoiding unnecessary extravagance, such as designer clothing. As Ramsey points out, even billionaires often dress simply despite their fortunes. Before splurging, Ramsey recommends building an emergency fund, paying off debt, and investing in retirement.

2. They Keep Their Vacations Private

Ramsey advocates for long-term wealth-building, and wealthy individuals tend to keep their spending on luxuries—like vacations—low-profile. As he notes, “They enjoy nice vacations but seldom post them on Instagram; they didn’t take you on vacation—they wanted to go on vacation.”

3. They Set Limits on Holiday Spending

Generosity is important to the wealthy, but that doesn’t mean splurging during the holidays. According to Ramsey, “The Christmas presents around the tree are very reasonable.” Instead of overextending during the season, wealthy people focus on building generational wealth for their families.

4. They Drive Cars Beneath Their Means

True wealth involves a long-term view, which means avoiding debt and high-cost purchases like luxury cars. Ramsey explains, “The car that they drive is understated... usually a used Camry or Honda.” This approach helps keep expenses manageable while supporting long-term financial goals.

Final Takeaway

In essence, the truly wealthy don’t rely solely on high incomes or lavish lifestyles. Instead, they build wealth through disciplined spending, intentional choices, and a focus on long-term goals—an approach that anyone can follow for financial stability and peace.

0 Comments